Your Introduction to Remote Cash Control

The new era of "Remote" Cash Management is here to stay

Retailers are urging their banking partners to tackle in a satisfactory manner their unfulfilled expectations, such as:

- Shorten the deposit to credit provision turn–around time

- Resorting less frequently to armored courier services

- Automate the reconciliation and reporting over the web

The last few years we observe a paradigm shift in to–date cash handling processes involving retailers:

- Remote Cash Control (RCC), the deployment of secure Cash Smart Safes (CSS) at merchant locations coupled with information reporting and provisional credit mechanisms, has been utilized for nearly 15 years as a means of improving merchant cash cycle control. Since 2004, when banks gradually began offering provisional credit based on validated currency residing at the merchant location, the industry has witnessed a surge in interest and adoption of these devices.

- For most merchants, couriers and banks, cash handling is still predominantly manual, but a growing number of institutions are starting offering Remote Cash Control products that sweeten the deal by offering provisional credit for deposits that are counted and validated by a "smart safe" that also provides audit trails for cash such as a Cash Recycler Machine (CRM ) or simply a Cash–In Machine (CIM).

- The primary benefit of RCC provisional credit is that it facilitates wholesale reengineering of the cash cycle within merchants and between merchants, armored couriers and bank cash vault networks. RCC removes the substantial burden of cash handling typically carried by bank branch personnel historically, largely without the assistance of meaningful automation.

In a mature RCC model, there is a large population of retailers equipped with modern CSSs.

- Retail clusters are owned (or franchised) by Retail Company.

- Retail Company, based on a services agreement, is coming in collaboration with a bank, enjoying a number of benefits, primarily provisional credit for cash stored in the CSS device(s).

- Bank is monitoring the installed CSS via web communications through a supevisory system as the CMN System.

- Cash inventory is fed to the banks on a daily schedule (one or more times per day), via the so-called "Cut-Off Report", updating the core banking IT systems

The Business Model for Remote Cash Control

Business drivers lead into building–up a purpose oriented RCC model

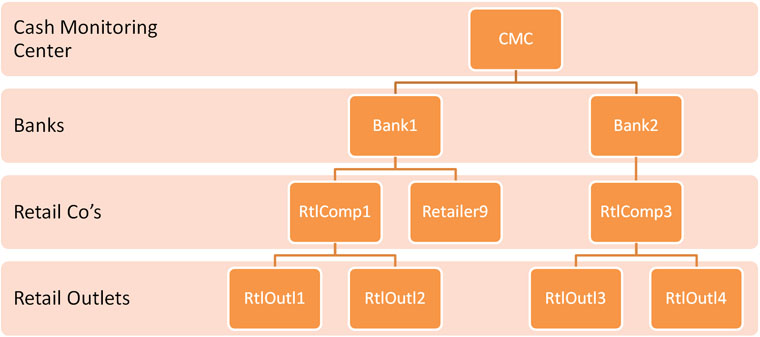

One aspect of the scheme is how we may approach the different business entities, acknowledging a hierarchy from a business point of view.

The diagram below depicts those hierarchy levels from a business point of view:

Looking in detail the business drivers and the business relationships (as they are articulated via binding legal agreements), the above diagram represents the so–called "RCC" business, led by one or more RCC companies, which is offering RCC services to a number of banks and is operating the CMC. Each bank has one or more client retail companies. At the end of the chain (actually an "inverted tree") each retail company owning/managing a chain of retail outlets, which may have (normally) one or (rarely) more CSS’s, connected on the CSS network.

The Information Technology Model

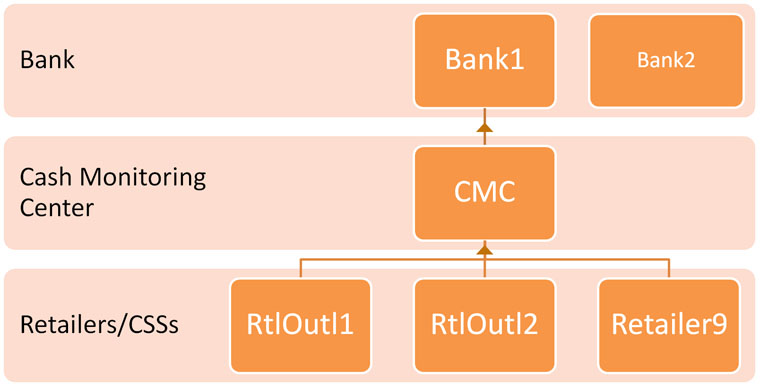

Hierarchy levels based on the information flow

Another aspect of this scheme is how we implement the information flow, via the information technology and digital communications, across the network entities. Apparently we observer a different hierarchy, reshuffling the layers presented above. The diagram below depicts these hierarchy levels from an IT point of view:

Practically the above diagram depicts the data information flow, where the CSS data (primarily the cash inventory) is collected by the CMC –in a store and forward manner– and then is forwarded to the bank owning the business relationship with the associated retail company.

Commercial Relationships

The RCC ecosystem citizens…

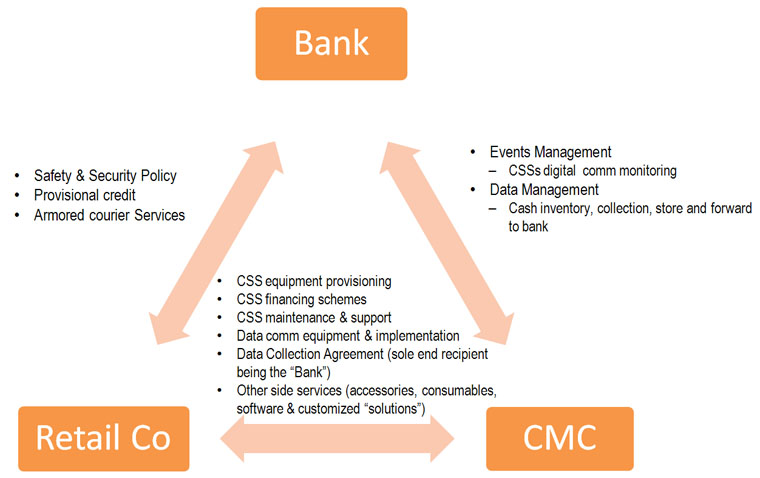

As described above, the three primary business entity categories are:

- The RCC Company (owning and operating the CMC)

- The Banks

- The Retail companies (owning, managing and operating the Retail Outlets)

The roles and responsibilities acknowledged between them, in order to ensure a stable integrated business ecosystem, are depicted in the following diagram:

YouTube

YouTube